| Afterpay ★ 3.8 |

|

| ⚙️Developer | Afterpay |

| ⬇️Downloads | 10,000,000+ |

| 📊Category | Shopping |

The Afterpay app is a game-changer in the world of online shopping, offering a convenient and flexible payment solution for consumers. With Afterpay, users can split their purchases into four interest-free installments, allowing them to buy now and pay later. This innovative approach to payments has gained popularity among shoppers who seek budget-friendly options and greater financial control. Let’s explore the features and benefits that make Afterpay a preferred payment method for millions of users worldwide.

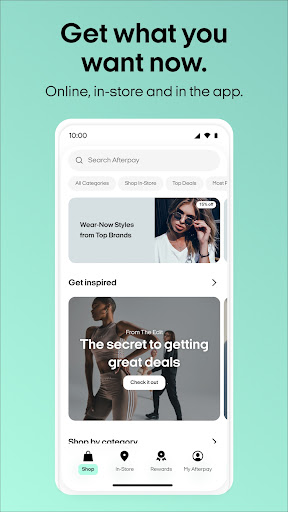

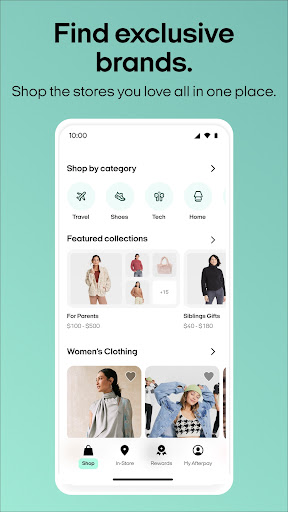

Afterpay offers a seamless and hassle-free shopping experience by integrating with numerous online retailers. Users can browse their favorite stores, add items to their cart, and choose Afterpay as their payment option during checkout. The app provides a simple and straightforward process, ensuring that users can enjoy their purchases without the burden of immediate full payment. With Afterpay, shopping becomes more accessible and affordable, opening up new possibilities for consumers.

Features & Benefits

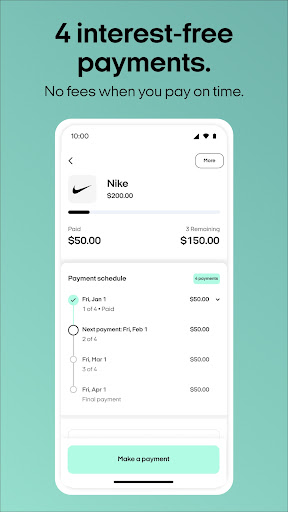

- Flexible Payment Option: Afterpay allows users to split their payments into four equal installments, paid over time. This feature provides financial flexibility, enabling users to manage their expenses more effectively. By breaking down the cost of purchases into smaller payments, Afterpay empowers users to make larger purchases without the strain of a one-time payment.

- Interest-Free Installments: One of the key advantages of Afterpay is that it offers interest-free installments. Users can spread out their payments without incurring any additional fees or interest charges. This feature makes Afterpay an attractive alternative to traditional credit cards or loans, as it provides a cost-effective way to manage expenses.

- Instant Approval and Easy Setup: Afterpay’s user-friendly interface ensures a quick and hassle-free setup process. Users can create an account within minutes and receive instant approval, allowing them to start using Afterpay immediately. The app’s straightforward setup eliminates the need for lengthy credit checks or complex verification processes, making it accessible to a wide range of users.

- Seamless Integration with Online Retailers: Afterpay integrates seamlessly with a vast network of online retailers, ranging from fashion and beauty to electronics and home goods. Users can shop at their favorite stores and choose Afterpay as their payment method at checkout. This integration eliminates the need for manual payment processes and provides a consistent user experience across multiple retailers.

- Payment Management and Reminders: Afterpay simplifies payment management by providing users with a clear overview of their upcoming installments. The app sends reminders when payments are due, ensuring that users stay on track with their payment schedule. These features help users stay organized and avoid late payment fees, enhancing their overall financial management experience.

Alternative Apps

Splitit:?Splitit allows users to split their purchases into interest-free installments using their existing credit cards. It requires no application or credit check and provides a seamless and convenient payment solution.

Quadpay:?Quadpay offers a “split it” payment option, allowing users to divide their purchases into four interest-free payments. The app is widely accepted at a range of retailers and offers a simple and transparent payment experience.

PayPal Credit:?PayPal Credit provides users with a line of credit that can be used for online purchases. It offers promotional financing options and flexible repayment terms, making it a popular alternative to traditional credit cards.

Affirm:?Affirm offers transparent and flexible financing options for online purchases. Users can choose from multiple repayment plans, including interest-free options, and enjoy a straightforward and user-friendly experience.

Pros & Cons

Frequently Asked Questions

Afterpay is a payment service that allows customers to shop online or in-store and pay for their purchases in four equal installments, due every two weeks. Once a customer selects Afterpay at checkout, they complete the transaction by paying the first installment upfront. The remaining three payments are automatically deducted from their linked debit or credit card over the following six weeks. This service helps consumers manage their spending without incurring interest when payments are made on time. To set up an Afterpay account, you need to visit the Afterpay website or download the Afterpay app. After providing your email address and creating a password, you’ll be asked to enter some personal details, including your name, date of birth, and payment information. Afterpay then performs a quick approval process based on your financial history. Once approved, you can start using Afterpay at any participating merchant. While Afterpay does not charge interest if payments are made on time, late payments will incur fees. Each missed payment can result in a fee ranging from $8 to $15, depending on your location. Additionally, Afterpay may restrict your spending limit if multiple late payments occur. It¡¯s important to monitor your payment schedule and make timely payments to avoid these fees. Yes, Afterpay can be used for international purchases, but only at select retailers that offer this payment option across borders. When shopping internationally, ensure that the retailer supports Afterpay for your country. Currency conversion may apply, and all transactions must comply with Afterpay’s terms and conditions, which vary by region. If you decide to return an item bought through Afterpay, you should follow the retailer¡¯s return policy. Afterpay will process the refund according to the retailer¡¯s procedures, and you will no longer be responsible for the remaining payments related to the returned item. Refunds are typically issued back to the original payment method used during the purchase. It¡¯s advisable to keep track of your order and payment details throughout the return process. You cannot directly change the payment method for ongoing Afterpay installments once the purchase is completed. However, you can update your payment information for future transactions. To do this, log into your Afterpay account and navigate to your account settings, where you can add a new card or update your existing payment information for upcoming purchases. Yes, Afterpay imposes a spending limit that varies based on your individual payment history and the retailer’s policies. New users may start with a lower limit that increases as you demonstrate responsible repayment behavior. If you miss payments or fail to repay on time, your spending limit may decrease. Afterpay continuously evaluates your usage patterns to determine your eligibility for higher limits. To reach Afterpay customer service, you can visit their official website and navigate to the help section, where you¡¯ll find various support options such as live chat, email, or phone support. They also have a comprehensive knowledge base that addresses common queries. Make sure to provide relevant details about your issue to receive prompt assistance.What is Afterpay and how does it work?

How do I set up my account with Afterpay?

Are there any fees associated with using Afterpay?

Can I use Afterpay for international purchases?

What happens if I want to return an item purchased with Afterpay?

Can I change my payment method for Afterpay installments?

Is there a spending limit with Afterpay?

How do I contact Afterpay customer service for issues?

Screenshots

|

|

|

|